(EcoFinances) – The GimacPay ecosystem, the platform of the Interbank Electronic Banking Group of Central Africa (GIMAC), recorded 7.5 million card and mobile transactions, for a cumulative amount of 377 billion FCFA during the first eight months of 2023, according to data communicated by its General Manager Valentin Mbozo’o, on Thursday 07 September 2023. Compared with 2022, this performance corresponds to realisation rates of 75% in terms of transaction volume and 95% in terms of cumulative amount realised.

This performance by the GIMACPAY ecosystem was largely boosted by the transfer and remittance service, which really stood out during the period under review. « This service has grown by a staggering 150% in terms of transaction volumes and cumulative transaction amounts. By 2023, people in the sub-region will have received more than CFAF 100 billion from outside the CEMAC zone in their bank/mobile Wallets via GIMACPAY, » he adds.

Migration from the current platform to a new, more efficient, flexible and secure version

According to the Managing Director of GIMAC, the performance of the GIMACPAY ecosystem will undoubtedly be stepped up in the coming weeks, with the migration of the current platform to a new version that is much more powerful, flexible and secure. « With delivery scheduled for the end of September (2023, editor’s note), the new version will enable users to boost their day-to-day electronic payment operations. We are on schedule with regard to the initial migration timetable, and we therefore plan to roll out phase 2, which consists of training the teams of the fifteen or so of our hosted members in the use of the application », he explains.

Deployment of 16 new interoperable mobile services by October 2023

At the same time, GIMAC plans to roll out 16 new interoperable mobile services by October 2023. These include receiving funds in real time on bank accounts, cards or vouchers; transferring funds outside the CEMAC zone to mobile accounts, bank accounts or prepaid cards; interoperable merchant request2pay; requesting confirmation from an electronic wallet prior to transfer; and loading and unloading interoperable bank or mobile Wallets from agents.

This deployment will bring to 22 the number of interoperable mobile services offered by GIMAC through the GIMACPAY ecosystem to date.

Innovations

As well as migrating the current platform to a new version that is more powerful, flexible and secure, and rolling out 16 new interoperable mobile services between now and October, GIMAC also intends to offer users two major innovations: an automated claims management application will be made available to the hundred or so Participants, along with an anti-money laundering application, to improve service quality and enhance compliance.

Complaints management

In terms of claims management, the hundred or so Participants will no longer have to enter GIMAC manually. « The application allows any user to post a claim and track its progress throughout the handling process until it is resolved. This tool brings considerable added value to performance-based management by entity« , Valentin Mbozo’o points out.

Transaction security

Security is not forgotten. It is palpable through the implementation of an essential aspect of any financial system, namely the fight against money laundering. « We are equipped with a daily activity monitoring application which, by means of filters, facilitates the monitoring and detection of any suspicious or fraudulent transaction. GIMAC is in action and remains on the course set by its governing bodies, under the high guidance of its statutory Chairman, Mr MAHAMAT ABBAS TOLLI, Governor of the Bank of Central African States, » explains the Managing Director.

33 million transactions processed since 2015

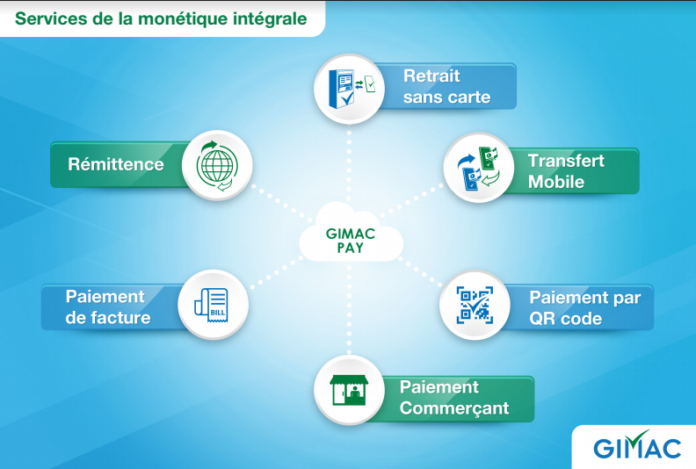

As a reminder, the GIMACPAY ecosystem has processed more than 33 million transactions since 2015 for a cumulative amount of more than FCFA 1,400 billion. Through its Participants, it offers CEMAC populations bankcard services as well as interoperable mobile transfer, merchant payment, bill payment and QR Code payment services; incoming remittance within the sub-region to mobile money or mobile banking accounts; voucher (secret code) generation and cardless ATM withdrawals.