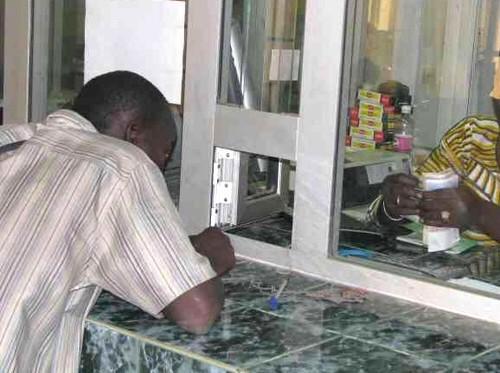

(EcoFinances) – Some fifteen banks and thirty or so microfinance institutions (MFIs) have agreed to support the State as part of its policy to combat the difficulties companies face in accessing credit in Cameroon, according to a press release issued by the Ministry of Finance on 11 August informing economic operators of the signing, on 16 August 2023 in Yaoundé, of a portfolio guarantee agreement between the State of Cameroon, credit institutions and microfinance institutions.

The agreement in question enshrines, we learn, « the effective implementation of the State guarantee facility for businesses, as provided for by the 2023 Finance Act, empowering the Government to endorse the State to public establishments and public and private businesses, in respect of domestic borrowing, for a total amount of FCFA 200 billion ».

A quick glance at the list of banks and MFIs that have agreed to support the State in its policy of backing and supporting private initiative shows that 15 credit institutions and 37 microfinance institutions are involved in this operation.

The banks are as follows: Afriland First Bank, Bange Bank, Banque Atlantique, BC-PME, BGFI Bank, Bicec, Citi Bank, Commercial Bank of Cameroon (CBC), Crédit Communautaire d’Afrique (CCA), La Régionale Bank, National Financial Credit (NFC), Pro-PME, Société Commerciale des Banques (SCB), Société Générale Cameroun (SGC), Union Bank of Cameroon (UBC). A total of 15 banks. Banks such as Access Bank, UBA Cameroun and Standard Chartered Bank are not included.

The MFIs are as follows: Acep, Advans Cameroun, Bapccul, Camccul, CCC-Plc, CCEC, CEC Cameroun, Cecec, CEPI, CMDC-SA, Conadie, Crédit du Sahel, Crédit Populaire, Express Union, Fidev SA, Figec, Financial House, First Trust, Focep, IDEV, MCD SA, Migec SA, Mintayen Cooperative Credit Union, Mufid, Mupeci, Nofia, Rainbow, Reccucam, Renaprov Finance SA, RIC, SCEC, Shiccul, Sofina, Unics, Univers Finance and Vision Finance.

The guarantee agreements, which should give public and private companies easier access to bank credit, were signed on 16 August 2023 in Yaoundé between the government and the banks and microfinance institutions.